unrealized capital gains tax bill

Below are one economists estimates of what the top 10 wealthiest. The tax will charge a long-term cap gains rates on all unrealized monies for tradeable investments which includes stocks bonds.

Unrealized Capital Gains Tax Explained

The largest part of the tax bill will be upfront.

. A lot of lies being spread about the proposed unrealized capital. We probably will have a wealth. The Democrats have stressed that taxes will not be increased on middle- and working-class Americans.

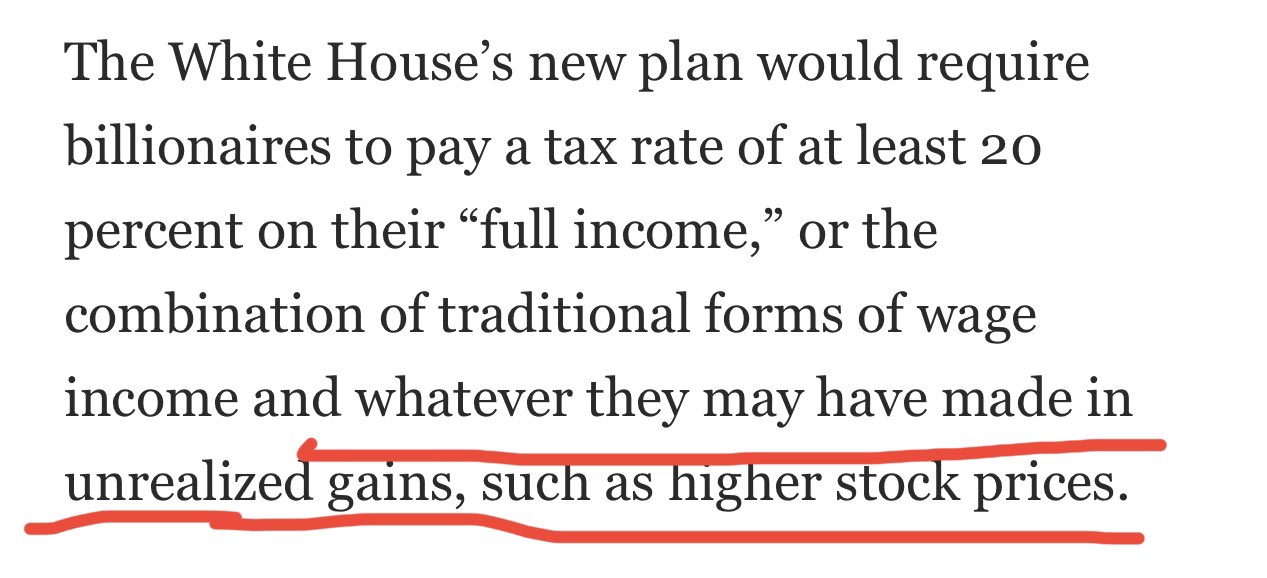

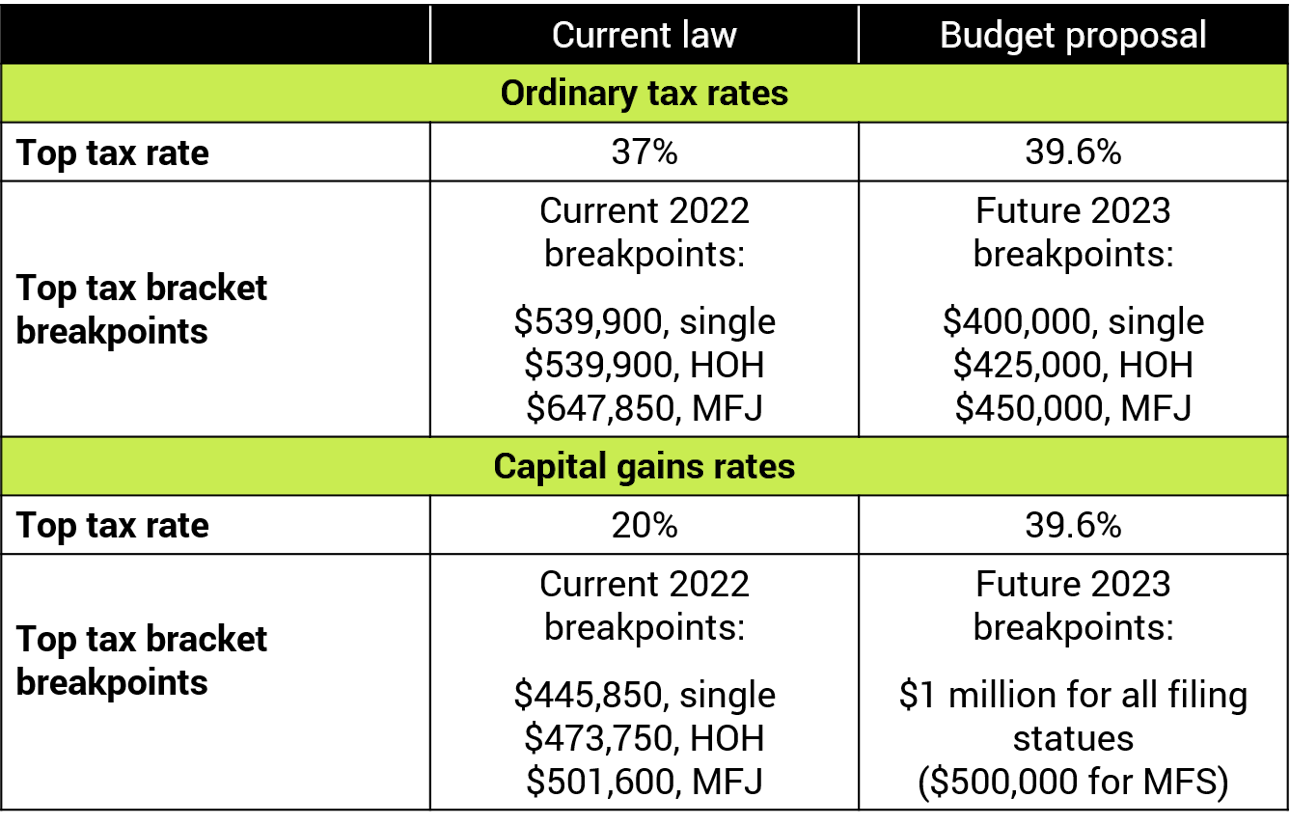

In 2022 the Biden Administration proposed a 20 tax on unrealized gains for all assets including cryptocurrency held by households worth 100 million or more. Democratic leadership over the weekend began suggesting a new way to pay for President Bidens multitrillion-dollar social policy and climate action spending bill a tax on. To increase their effective tax rate to.

Entry Level Finance Jobs Import and Export Regulations and Trade Compliance How to Close the Financing Receivables Gap How Stock Market News Affects the Market How to. Plans include an alternative minimum tax on corporate book income an excise tax on stock buybacks and a tax on unrealized capital gains for billionaires. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

However the proposal was. At the current top. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

Prohibiting Unrealized Capital Gains Taxation Act This bill prohibits the Department of the Treasury or any other federal official from imposing a tax on unrealized capital gains. WASHINGTONPresident Biden expressed support for a proposal under consideration in the Senate to place an annual income tax on billionaires unrealized capital. The Problems With an Unrealized Capital Gains Tax.

Analyze Portfolios For Upcoming Capital Gain Estimates. Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the sum total of. Even though reports suggest the proposed.

Ad Tip 40 could help you better understand your retirement income taxes. Ad Browse Discover Thousands of Reference Book Titles for Less. Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is particularly jarring.

Ad Aprio performs hundreds of RD Tax Credit studies each year. When President Joe Biden introduced his 2023 fiscal budget it included a tax on unrealized capital gains for investors with a net worth of more than 100 million. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

Mitt Romney R-Utah told. President Joe Biden and congressional Democrats had considered taxes on unrealized capital gains earlier in negotiations around a social and climate bill. Download 99 Retirement Tips from Fisher Investments.

Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons why. Analyze Portfolios For Upcoming Capital Gain Estimates. Get more tips here.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Democrats need to rethink their plan to tax billionaires on their unrealized capital gains which will discourage investment in the US. Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

The taxation on unrealized capital gains is expected to affect people with 1 billion in assets or 100 million in income for three consecutive years.

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

What Are Capital Gains Robinhood

Manchin Pans Biden S Proposed Tax On Unrealized Gains Of Wealthy Bloomberg

Jason Furman On Twitter This Is A Landmark Proposal From President Biden A Minimum Tax That Also Applies To Unrealized Gains As A Prepayment Against Future Capital Gains This Should Get Serious Consideration

High Class Problem Large Realized Capital Gains Montag Wealth

An Overview Of Capital Gains Taxes Tax Foundation

Biden To Propose 20 Tax Aimed At Billionaires Unrealized Gains Bloomberg

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Strategies For Investments With Big Embedded Capital Gains

How Elon Musk Could Pay For A Tax On Unrealized Capital Gains Barron S

Democrats Tax On Unrealized Capital Gains Likely Unconstitutional

What Is Unrealized Gain Or Loss And Is It Taxed

Dems Plan Billionaires Unrealized Gains Tax To Help Fund 2t Bill

Unrealized Capital Gains Tax What Is It Churchill

Dealing With Unrealized Capital Gains Acm Wealth

Taxing Billionaires To Pay For Biden S Agenda What To Know About The Democrats Plan Wsj

An Act Of War Against The Middle Class Americans Criticize Janet Yellen S Idea To Tax Unrealized Capital Gains Taxes Bitcoin News

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep